Join the 30,000+ businesses leveraging Kurv

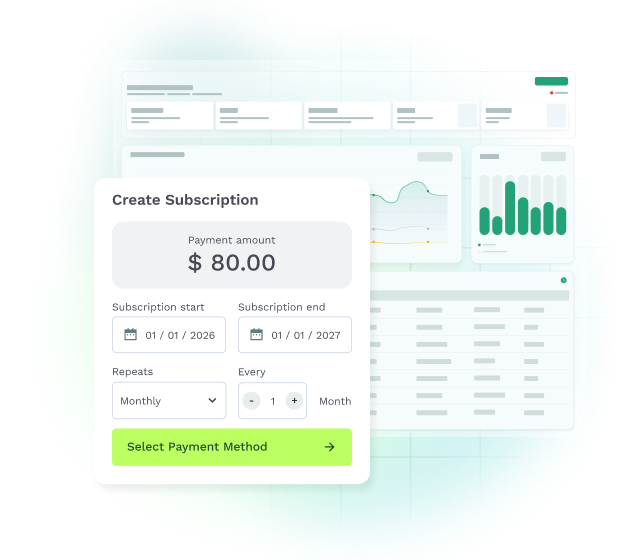

Recurring Payment Processing

Kurv Recurring Payment Processing automates billing for subscriptions, memberships, and ongoing service plans by securely charging customers on a set schedule. Our platform reduces manual invoicing, minimizes failed payments with smart retry logic, and improves retention through automated dunning management. Ideal for SaaS, gyms, professional services, and any business with recurring revenue models.

🔥Automate subscription billing

🔒Protect your recurring revenue

Built-in Features that Keep You Growing

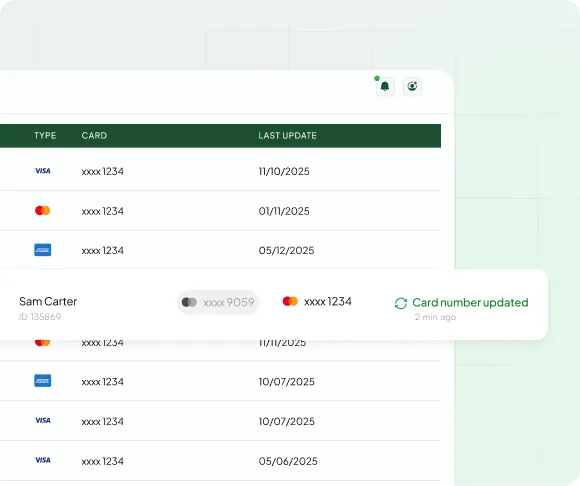

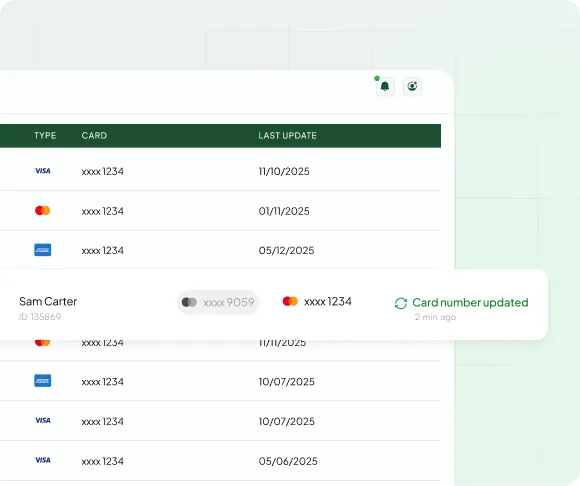

Automated Retries & Failed Payment Recovery

Recover failed payments with ease. When a charge is declined due to insufficient funds, expired cards, or other common issues, Kurv automatically retries on a smart schedule and prompts customers to update their payment details instantly. Reduce involuntary churn, protect your revenue, and keep recurring billing running smoothly.

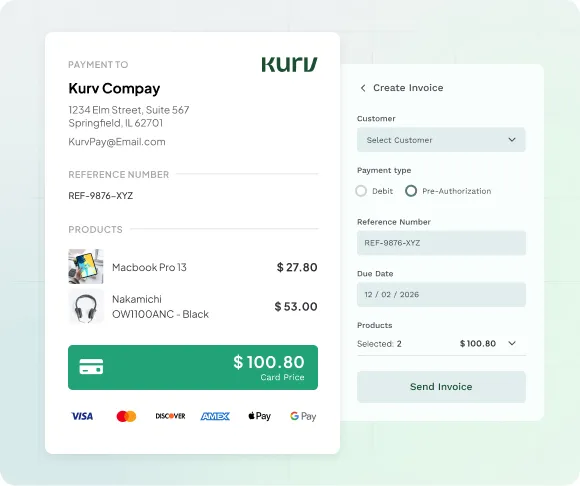

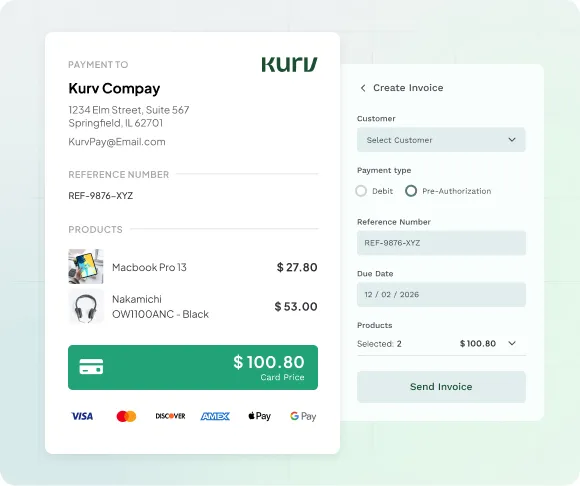

Built-in Invoicing and Receipts

Streamline billing from start to finish with digital invoices and automatic receipts. Create, send, and track invoices in minutes while our system generates receipts instantly after every payment. Your business stays organized, saves time, and benefits from scalable tools that grow with you.

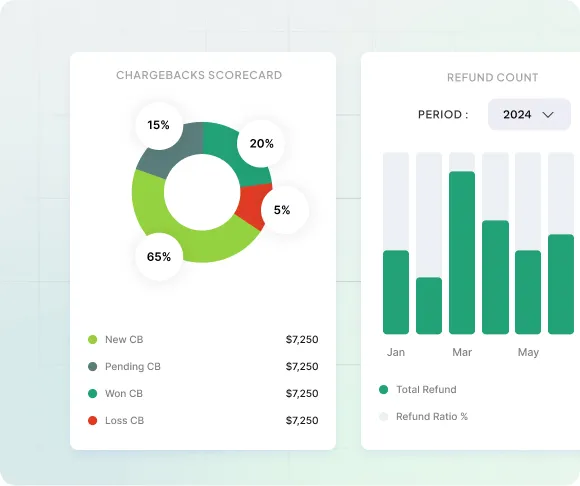

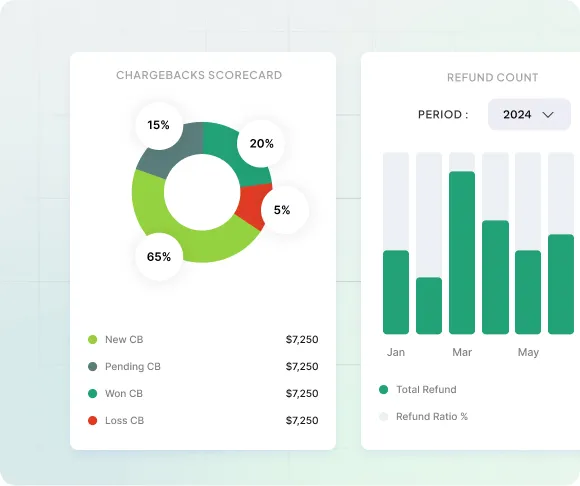

Real-time analytics & reporting

Kurv’s intuitive dashboard provides real-time insights into your payments and overall business performance. Monitor trends, track key metrics, and uncover opportunities to improve efficiency and maximize your operations.

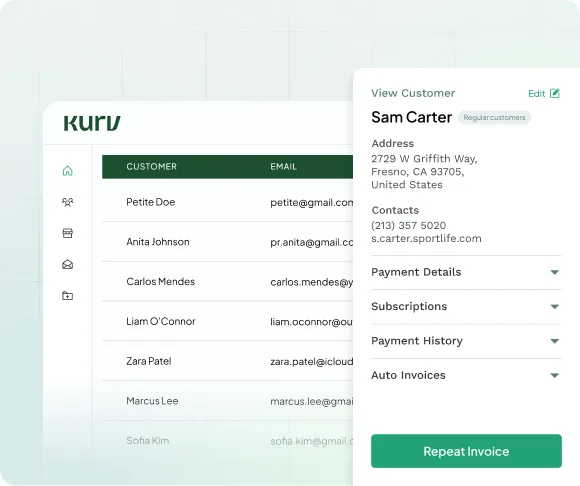

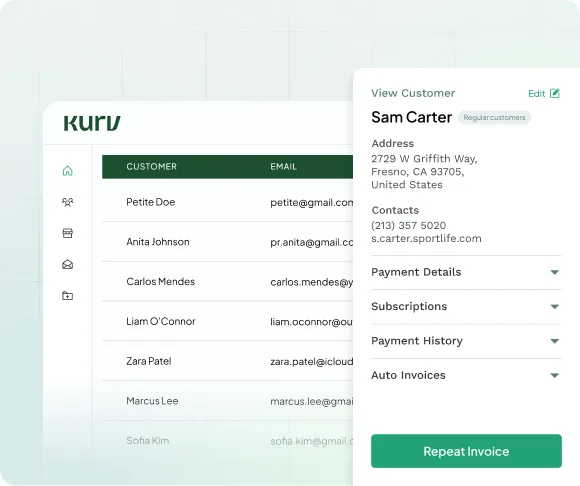

Customer profile management

Manage customer data, payment history, and billing preferences all from one unified platform. Our tools help you keep customer information organized, provide clear insights, and simplify payment and billing management as your business scales.

Recurring Payments for Every Business Type

Whether you run memberships, subscriptions, or ongoing services, Kurv makes it simple to automate billing and keep payments running smoothly.

Integrations That Fit Your Stack

Explore integrations designed to elevate your business.

Simple, Transparent Pricing. No Fluff.

Keyed & Online

IC+ and Volume Discounts

How Recurring Payments Work with Kurv

Quick Start

Start offering recurring billing in no time—set up plans right from your merchant dashboard.

Secure Customer Authorization

Capture payment info once—Kurv tokenizes and securely stores it.

Automatic Billing and Notifications

Process payments on-schedule with real-time alerts and reporting.

Flexible Management Tools

Modify, pause, or cancel subscriptions easily from your dashboard.

The Kurv Advantage

Automated Services

Sign up for automated subscriptions, reminders, and requests. Save time and money as you scale.

Stabilized Cash Flow

With Kurv, you get accurate, up-to-the-minute revenue forecasts. Focus on retaining buyers by delivering an exceptional customer experience.

Hands-On Support

With a team that lives and breathes payments, Kurv’s trusted experts are ready to give your business the support it deserves.

Frequently Asked Questions

How do I set up recurring payments with Kurv?

Kurv’s recurring payment function is included with its processing services, which also include inventory management and contactless features, plus APIs, integrations, and more.

To set up recurring payments, create a detailed payment schedule that automatically processes future charges at consistent intervals, such as weekly, monthly, or annually, based on your billing requirements and spending patterns.

Can customers change, pause, or cancel their subscriptions easily?

For accuracy and security, any updates to a payment schedule are handled by the merchant on behalf of the customer.

What payment methods can I use for recurring billing?

Customers using Kurv’s payment tools can set up recurring billing using credit or debit cards. Alternate options include invoicing, email links, and even text-to-pay.

Can I accept recurring payments without a website?

Yes, you can accept recurring payments without a website. Paper invoicing and mobile payment requests are two examples of this.

How does Kurv handle failed recurring payments, retries, and payment-fail scenarios?

Kurv’s user-friendly software can auto-update expired cards, thus reducing your failed payment margin.

Is recurring billing secure and PCI compliant?

Yes, since recurring billing accounts handle sensitive financial data, they adhere to all PCI compliance requirements.

How quickly can I start processing recurring payments?

Most merchants will be able to start processing recurring payments after 1-3 business days.

Recurring Payments, Reinvented

At Kurv, we’re redefining how money moves. Together, we’ll unlock opportunities, grow smart, and power the next wave of financial innovation.

Choose progress. Choose Kurv.

Join the 30,000+ businesses leveraging Kurv