Join the 30,000+ businesses leveraging Kurv

B2B Payment Processing & Merchant Account Services

Kurv makes B2B payment processing simple, secure, and scalable so you can move money faster and build stronger relationships.

🔥 Free terminal options for new customers!

🔒 Secure, simple, and quick application process.

B2B Businesses We Support

Wholesalers

Marketing & Advertising

SaaS Provider

Package Fulfillment

How It Works

Quick Start

Tell us about your business, select hardware, and continue to full app.

Complete Application

Fill out your details, review pricing, and digitally sign the application.

Rapid Verification

Connect with Finicity to skip doc uploads & complete fast KYC.

Receive Approval in Minutes

Accept payment online instantly or as soon as you get your terminal.

Merchant Tools & Support

Access your portal for reports. We’ll ensure everything runs smoothly.

Ways to Simplify B2B Payments with

Flexible Options

Simplify complex transactions with modern tools that help you accept B2B payments securely and on your terms. From credit cards to wire transfers, ACH, and eChecks, Kurv offers the flexibility your business clients expect.

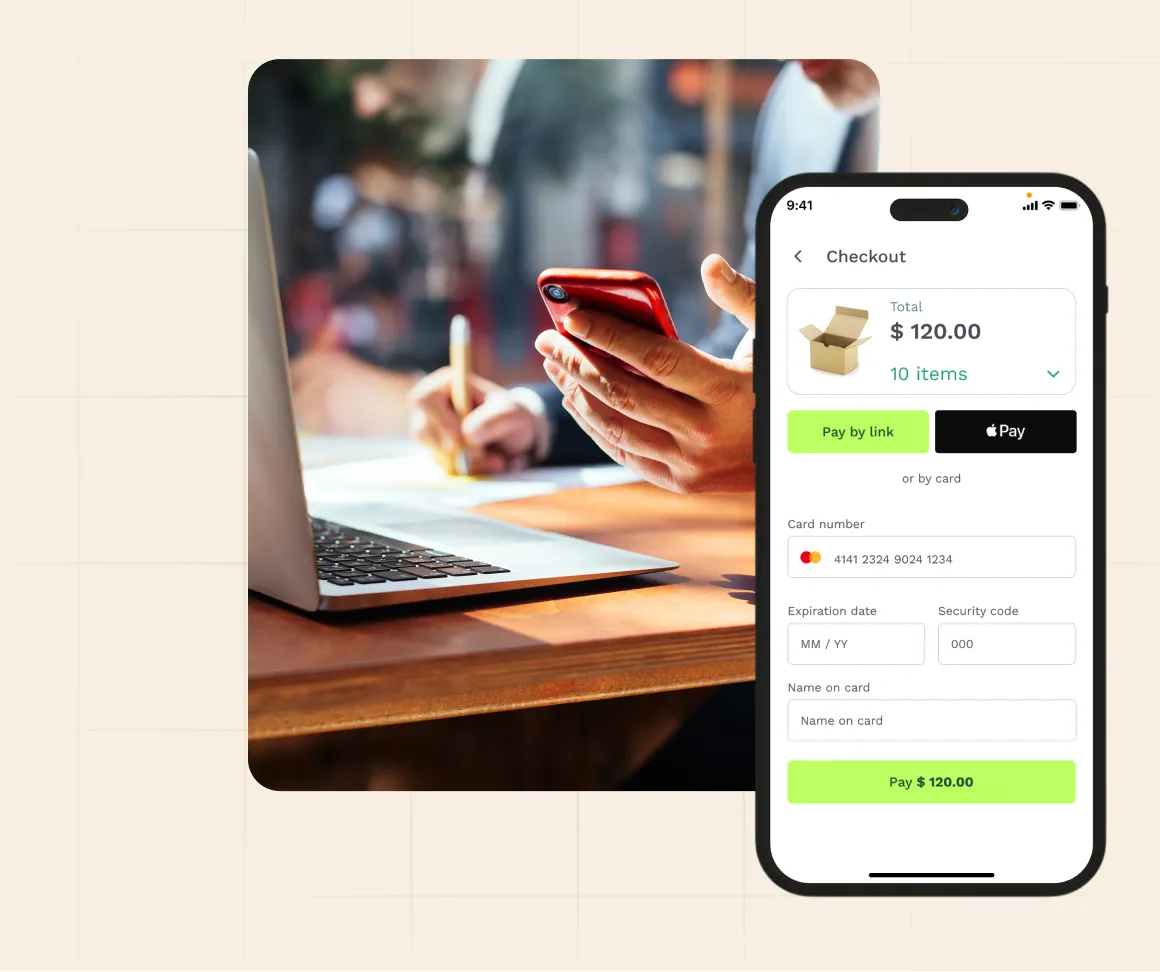

Offer The Basics with Credit Card Acceptance

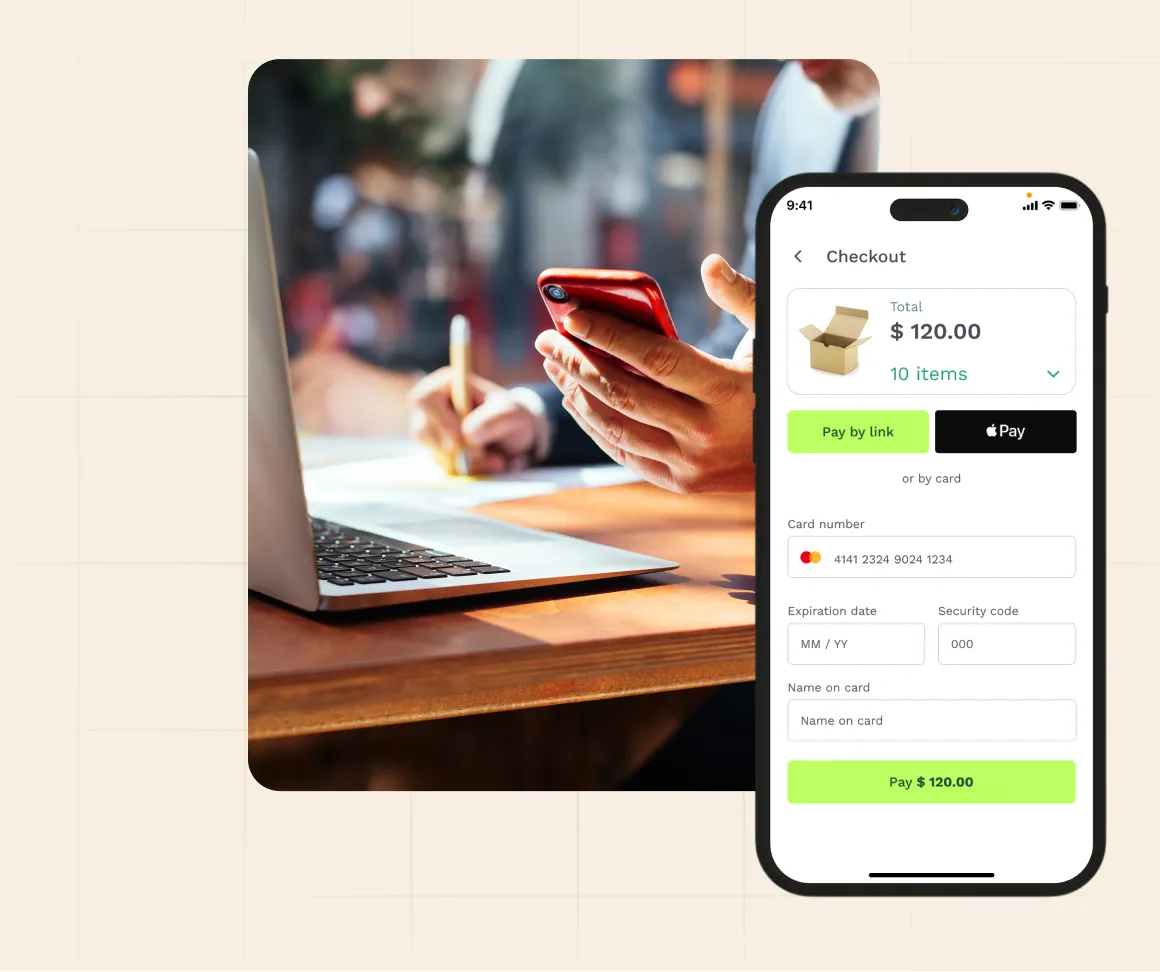

Make it easy for your clients to pay with fast, reliable credit card processing in person, online, or on the go.

Reduce friction at every touchpoint with:

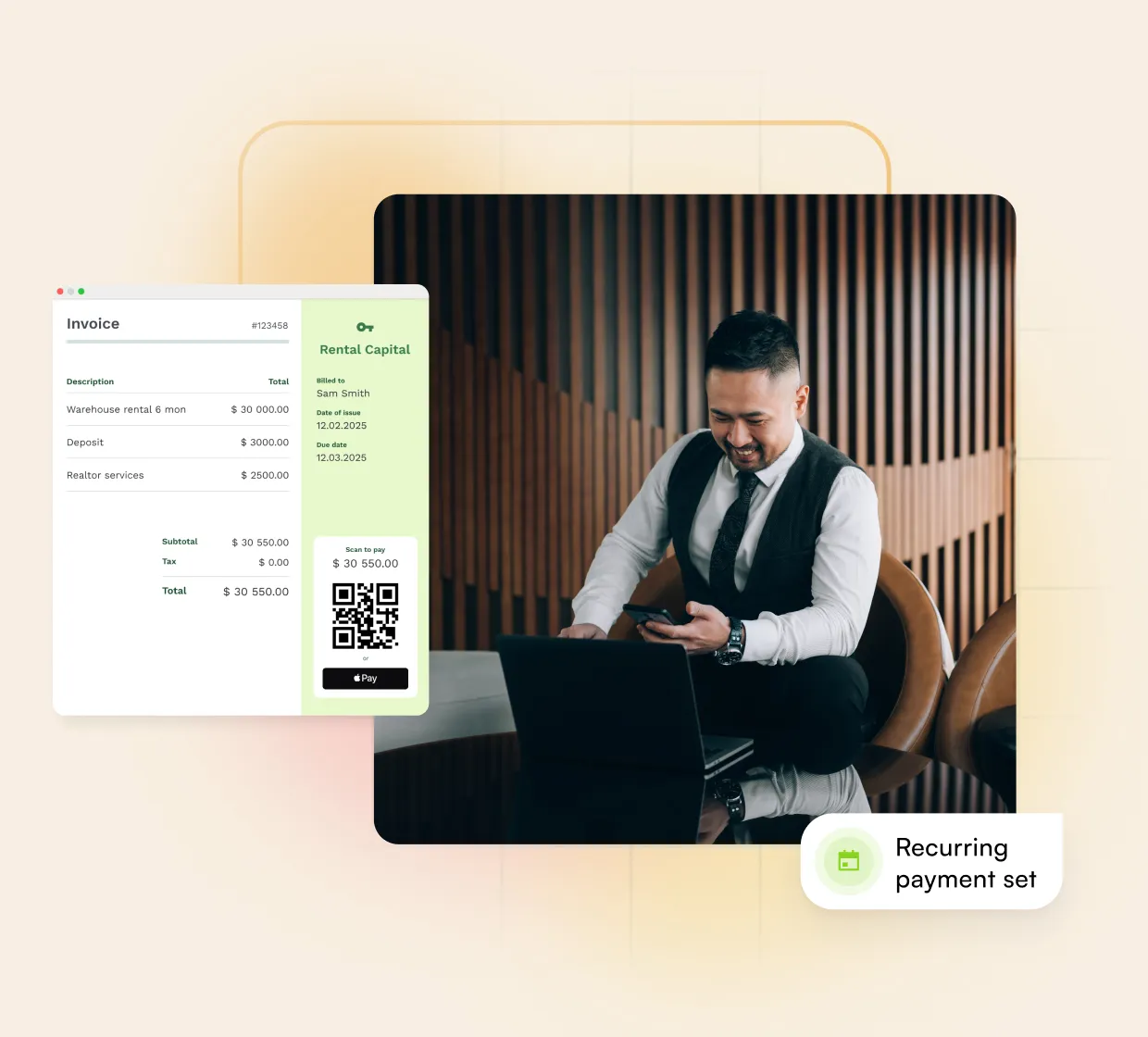

- Payment links sent via text or email

- Branded payment gateway checkout page

- Scan to pay QR codes

Mobile app and desktop dashboard logins for your whole team to access payment functionality any time and from wherever they are.

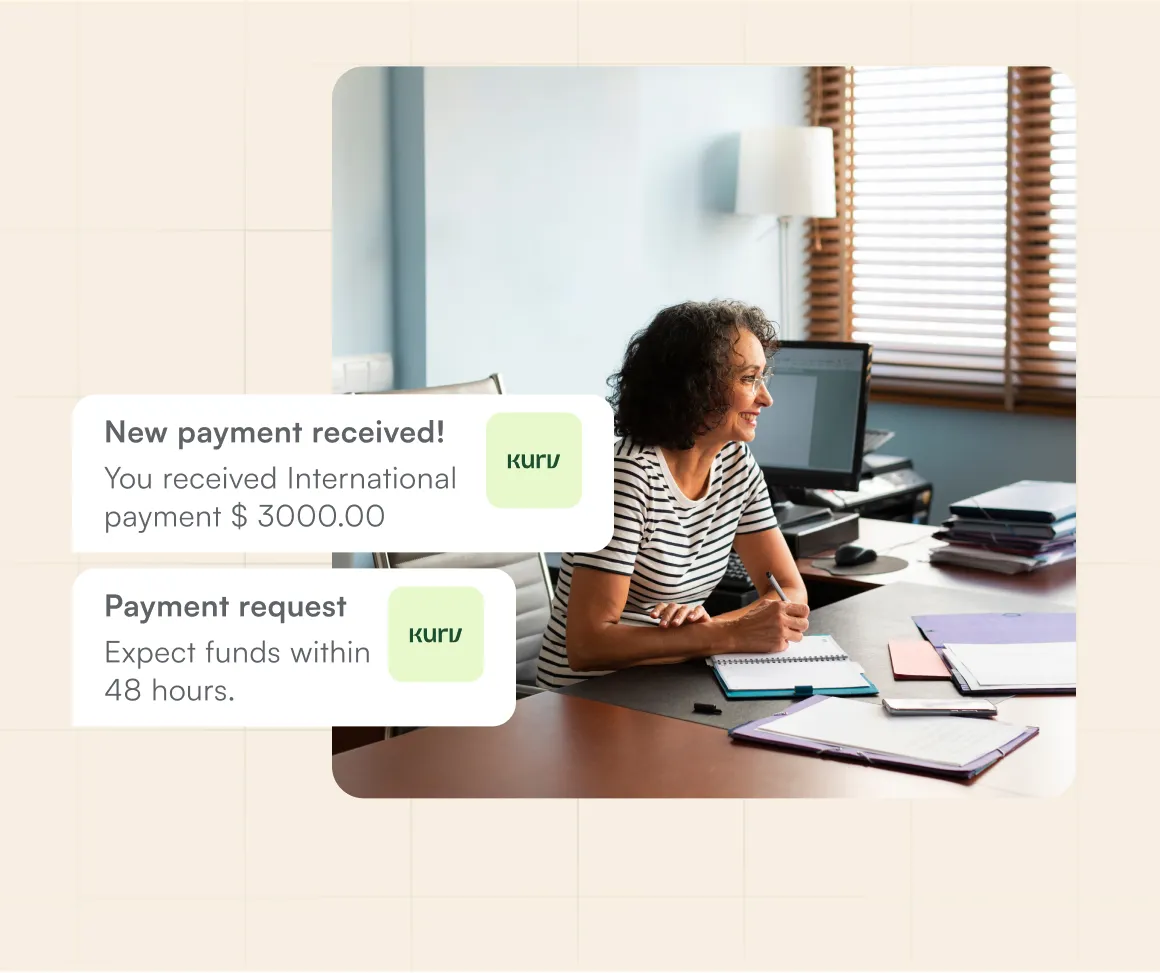

Get Paid Faster with Real-time Wire Transfers

Choose a speedy, straightforward, and secure option for transferring funds.

- Integrate seamlessly with your existing system

- Manage domestic and international bank connections

- Handle time-sensitive payments with ease

- Extra security measures ensure you’re protected

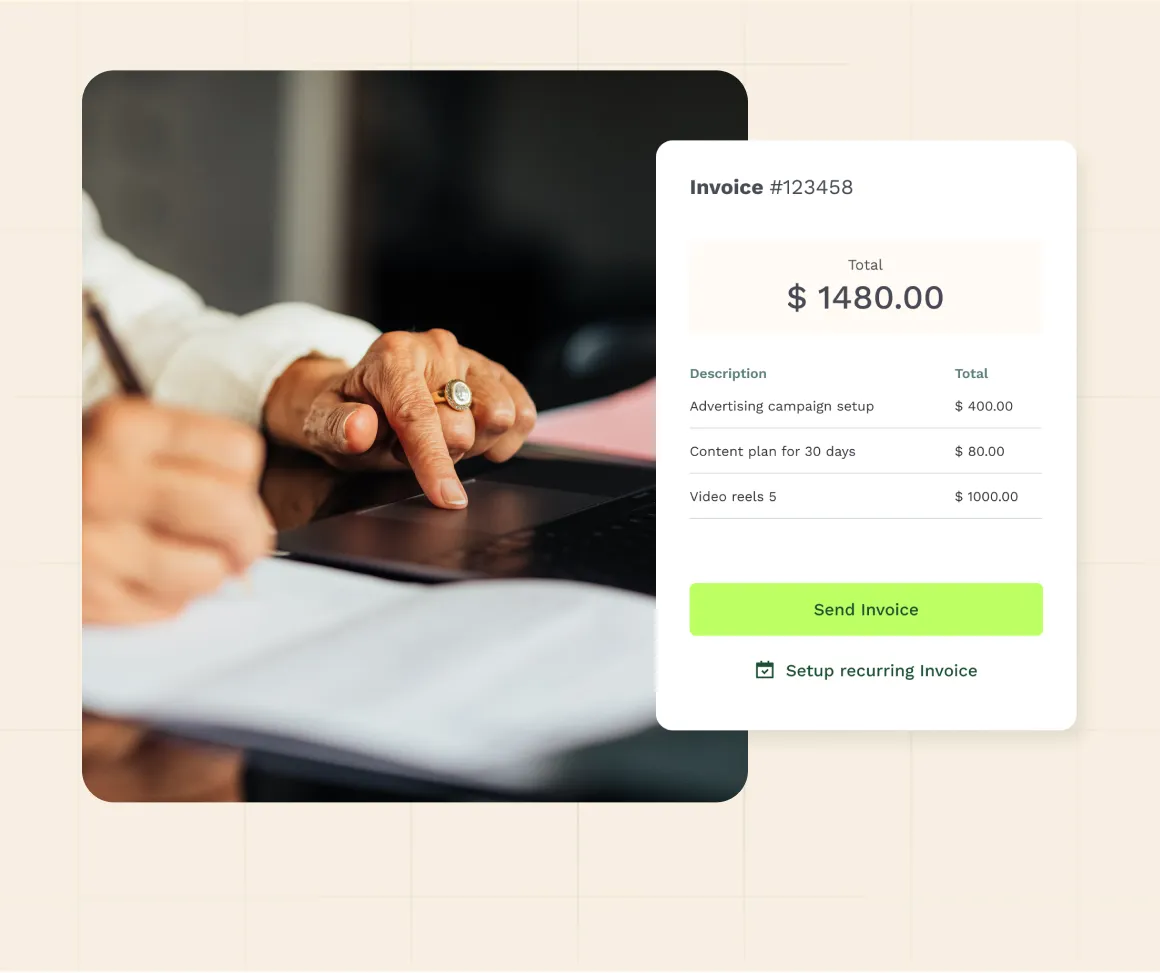

Cut Costs and Save Time Using ACH

Minimize processing costs while maximizing efficiency by offering the increasingly popular ACH processing.

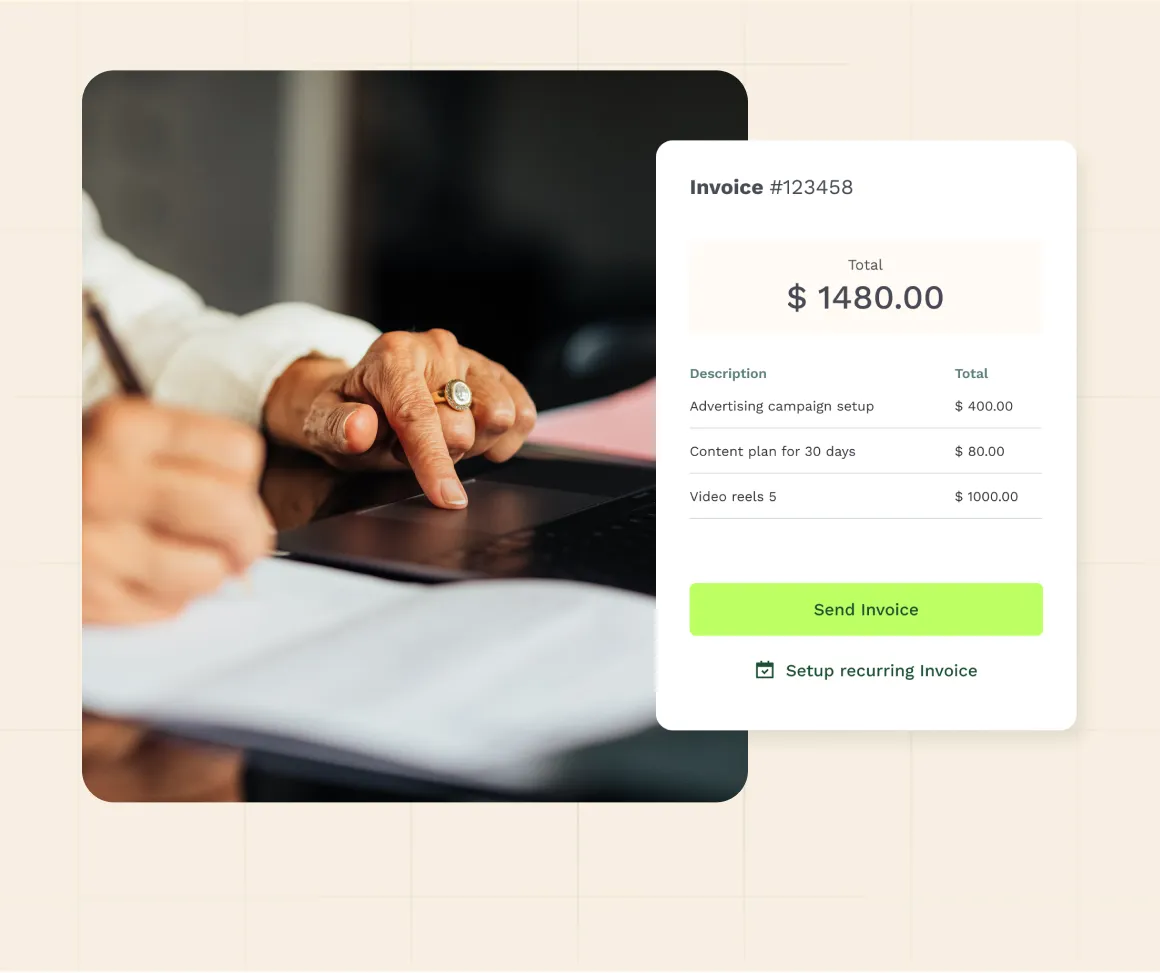

- Automate recurring invoices and direct deposit

- Reduce manual processes and reconciliation

- Speed up back-office operations

- Ensure security both sending and receiving

- Get your money quicker

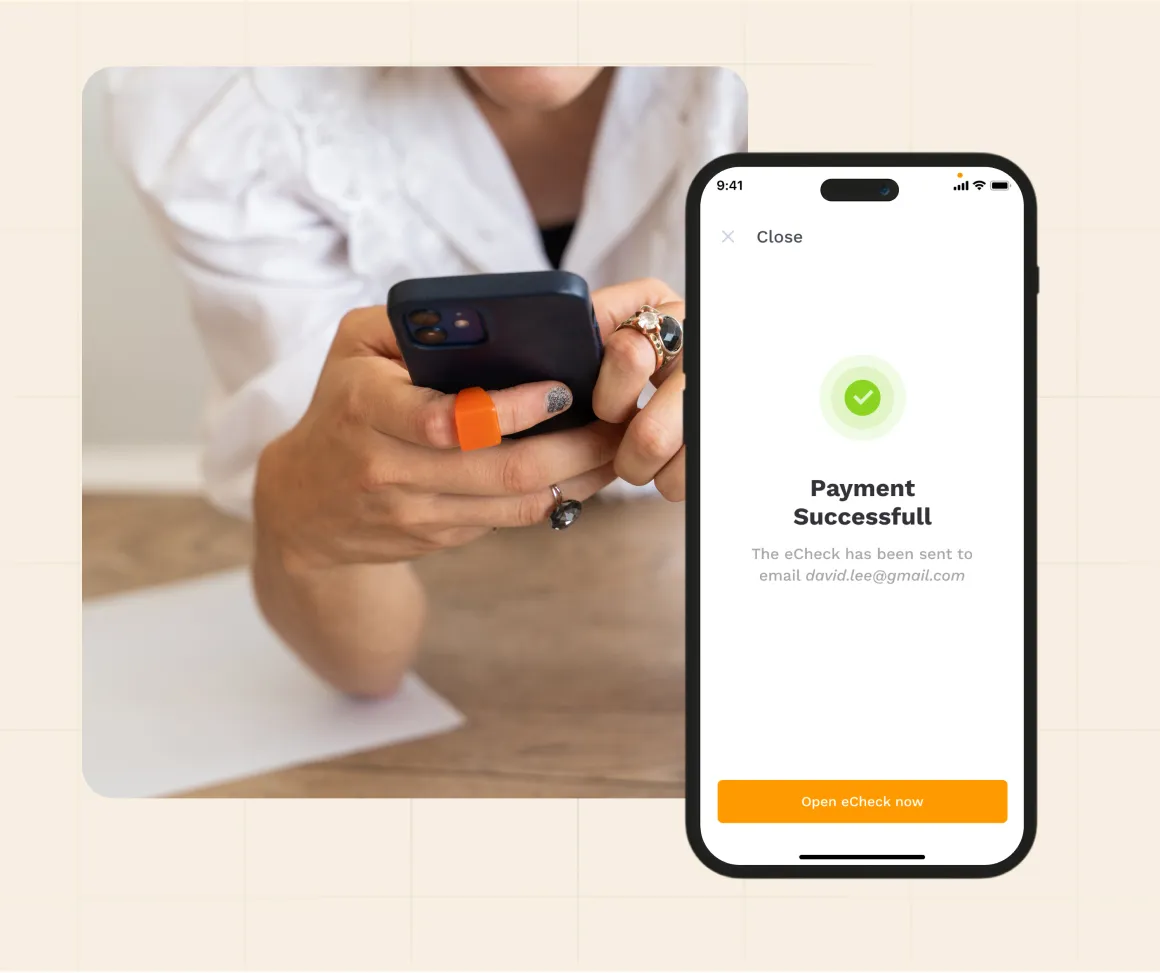

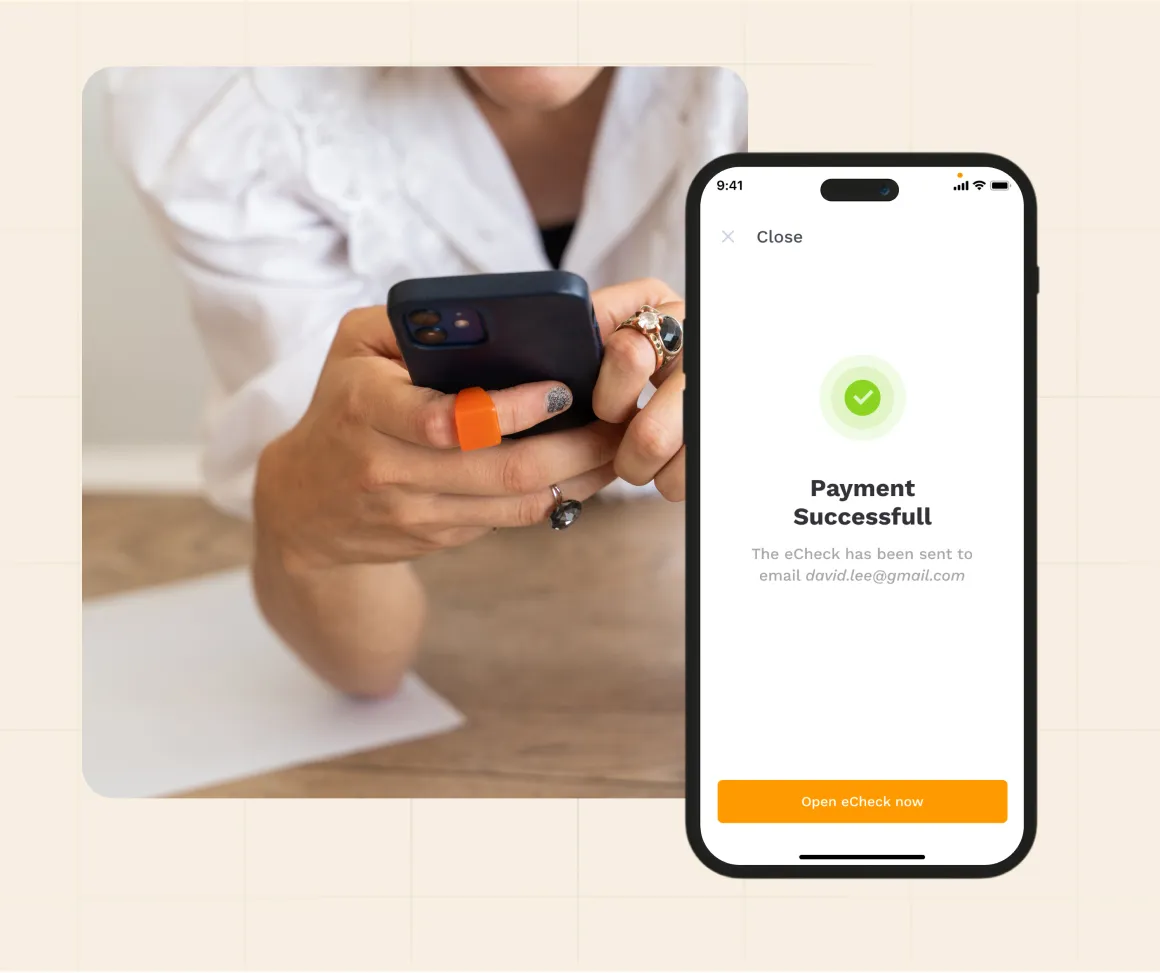

Maximize Flexibility with eChecks

Streamline your payment acceptance with secure digital check processing that meets your clients where they are.

- Simplify one-time payments

- Security measures ensure accuracy every time

- Quick and timely deposits

- Easy authorization requests

Manage Payments Smarter with Advanced Tools

Build Your Perfect Point of Sale Ecosystem

Browse our selection of versatile payment terminals and find the perfect fit for your B2B business.

Connect the Tools You Already Use

Kurv integrates with CRMs, invoicing software, and ERPs so you can sync payments with the rest of your workflow.

The Kurv Advantage

Flexible Payments

Credit cards, ACH, wires, and eChecks—all in one platform, so your clients can pay their way.

AR Automation

Kurv places powerful tools at your fingertips to streamline accounts receivable automation.

Level 2 & 3 Processing

Benefit from reduced risk and lower processing fees through level 2 & 3 processing.

Scalable Up & Down

Whether you manage five clients or five hundred, Kurv grows with your accounts and workflows.

Transparent Pricing

Reduce overhead with predictable pricing models and cost-efficient methods.

24/7/365 Support

Get answers from real people who understand complex billing, B2B workflows, and you.

Dr. Nick Sienkiewycz

Simply Health Chiropractic

“I’ve chosen a processor that will make it so that I can dedicate more of my time to my patient.”

10+ Dedicated Years with Us

A committed rep keeps them up-to-date with PCI and HIPAA regulations.

Free Hardware Upgrades

Ensures they are always using cutting-edge payment technology.

Full-Service Support Team

A devoted team of support specialists standing by 24/7/365.

Frequently Asked Questions

Do you integrate with accounting or ERP systems?

Yes, Kurv integrates with popular accounting and ERP systems like QuickBooks or secure APIs to streamline B2B financial workflows.

Can I manage multiple clients or locations under one account?

You can manage multiple clients or locations under one centralized account for easy payment processing, tracking, and reconciliation. We even have PayFac and embedded payments solutions depending on your needs.

How do you help reduce failed payments or chargebacks in B2B?

Kurv safeguards your B2B transactions with PCI Level 1 gateways (with tailored fraud parameters set to your business), robust fraud and chargeback monitoring and reporting tools that help identify issues, manage disputes, and reduce the risk of friendly fraud.

How does Kurv support large-ticket transactions or custom billing workflows?

Kurv’s solution enables large ticket transactions and reduces costs via level 2 & 3 processing capabilities. We offer payment options such as ACH transfers, custom invoice links, and recurring payments to support larger transactions and streamline billing workflows.

How quickly can we get onboarded and start processing?

Kurv offers instant onboarding and auto-approvals for many B2B businesses, allowing merchants to start accepting payments in as little as 24 hours. However, due to individual factors, this timeline may be subject to change.

Payments You Can Trust, Peace of Mind You Deserve

Start accepting payments instantly

Join the 30,000+ businesses leveraging Kurv