Join the 30,000+ businesses leveraging Kurv

Complete Merchant Fraud Protection with Kurv

Protect your customers and your business. As a Level One PCI Compliant company, your data is always safe with us.

🔥 Free terminal options for new customers!

🔒 Secure, simple, and quick application process.

Shield Your Merchant Account from Fraud

Kurv’s powerful suite of credit card, debit card, and eCommerce fraud prevention tools identifies fraud and protects you from risk.

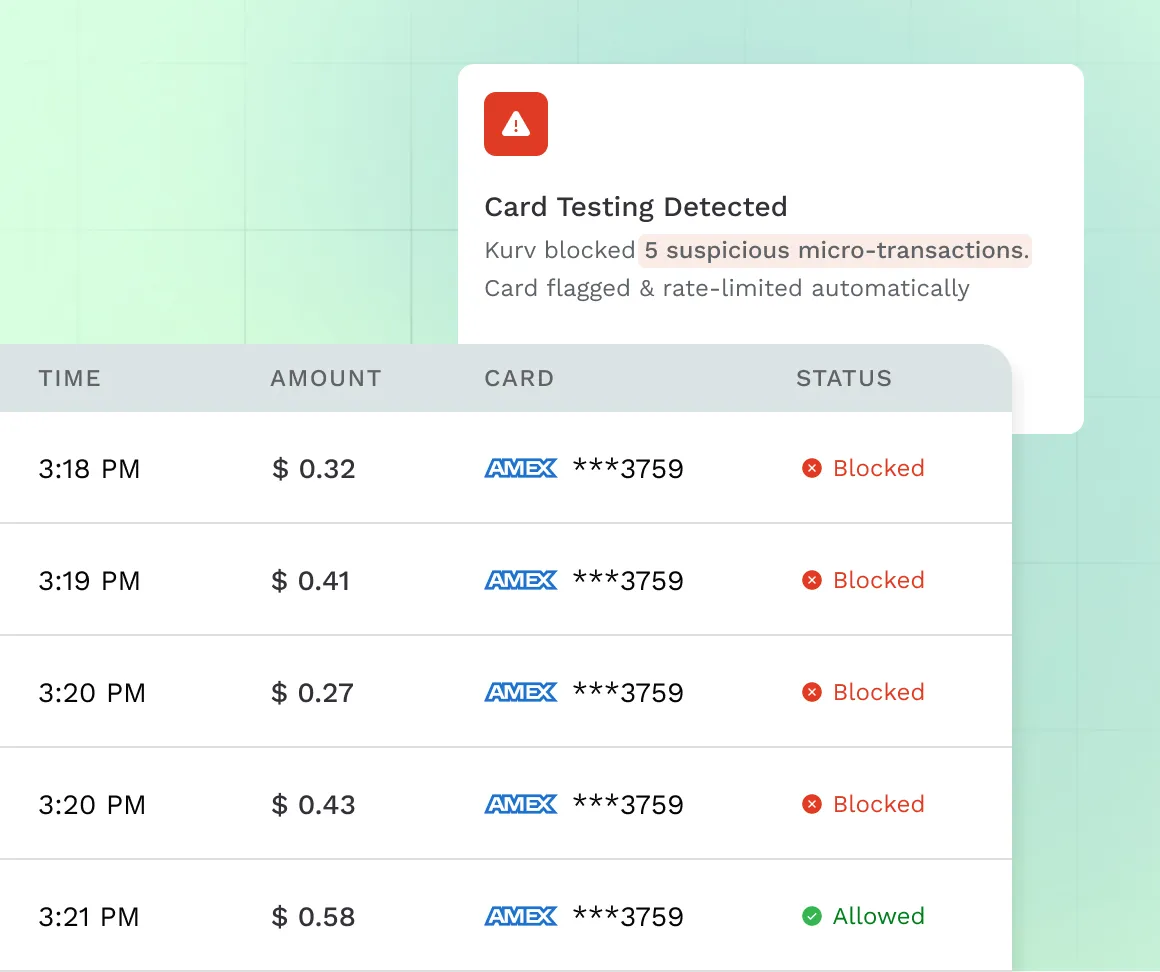

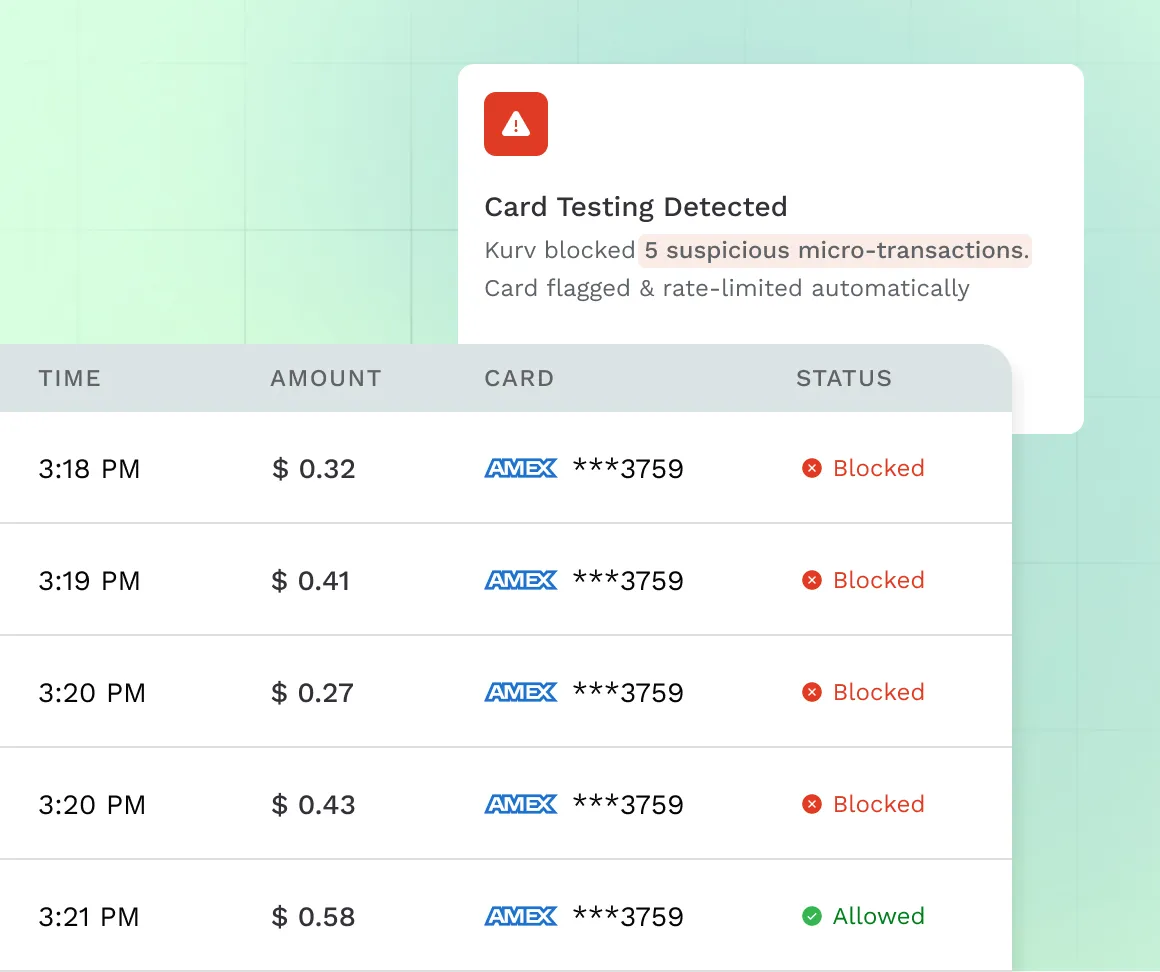

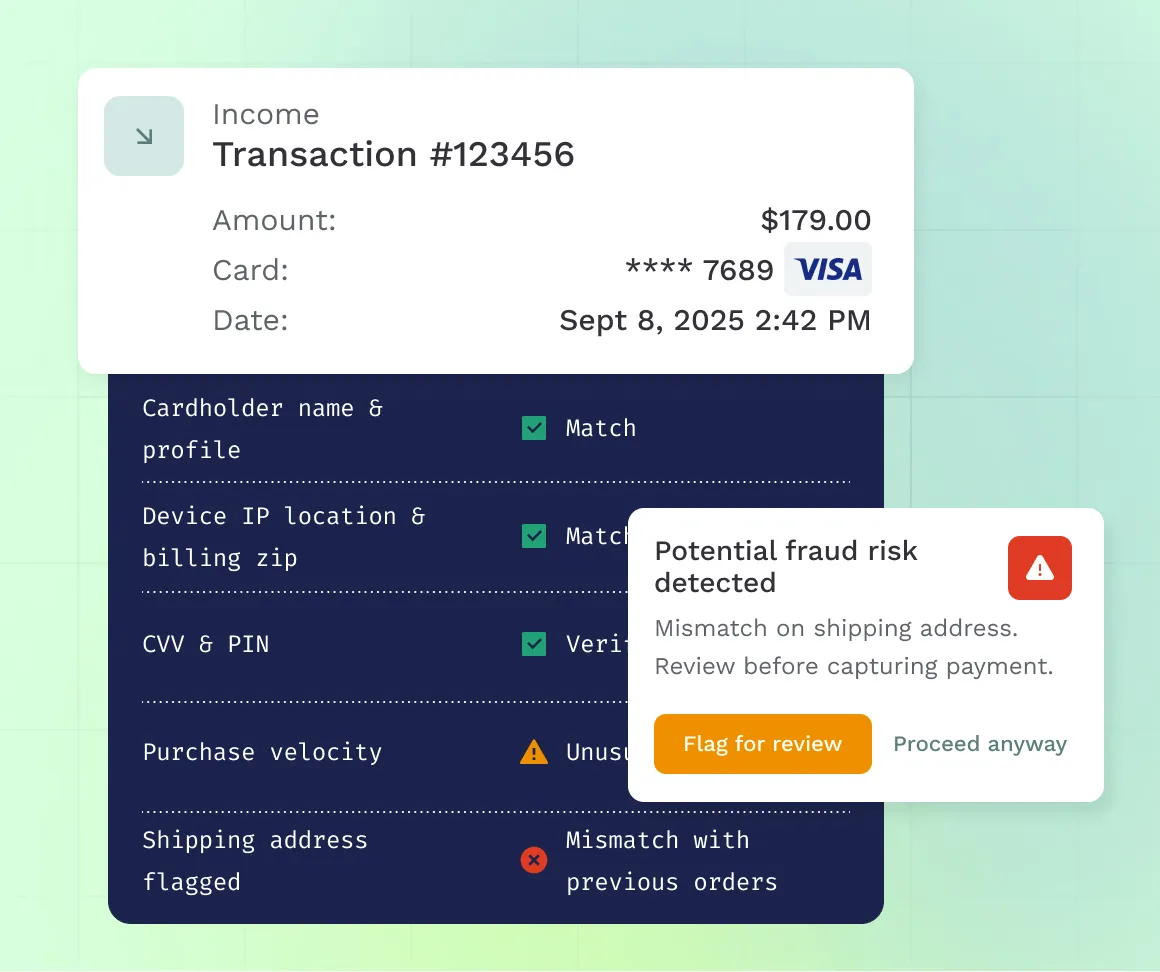

Behavior & Velocity-Based Risk Analysis

Monitor fraud before it happens.

- Track customer behavior patterns and flag unusual transaction speeds or volumes.

- Detect bots, card testing, and repeated attempts before they escalate into chargebacks.

- AI-driven velocity checks learn over time to stop evolving fraud tactics.

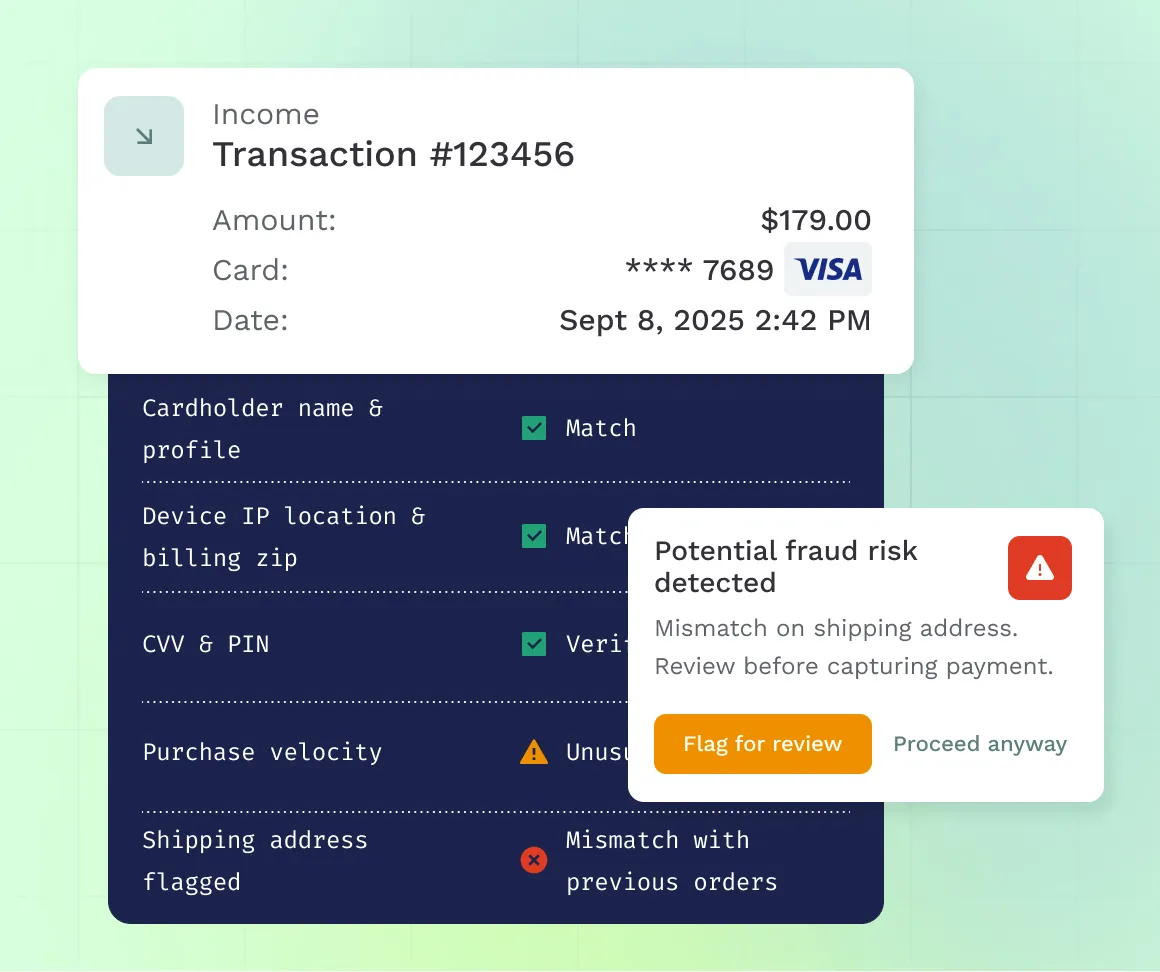

Prevent Identity Abuse & Stolen Cards

Stop high-risk activity at checkout.

- Analyze transaction-level details instantly: IP, device, shipping, billing ZIP, CVV, and more.

- Compare current actions to past behavior for signs of identity theft, synthetic fraud, or account takeover.

- Automatically flag suspicious transactions for review — or block them instantly.

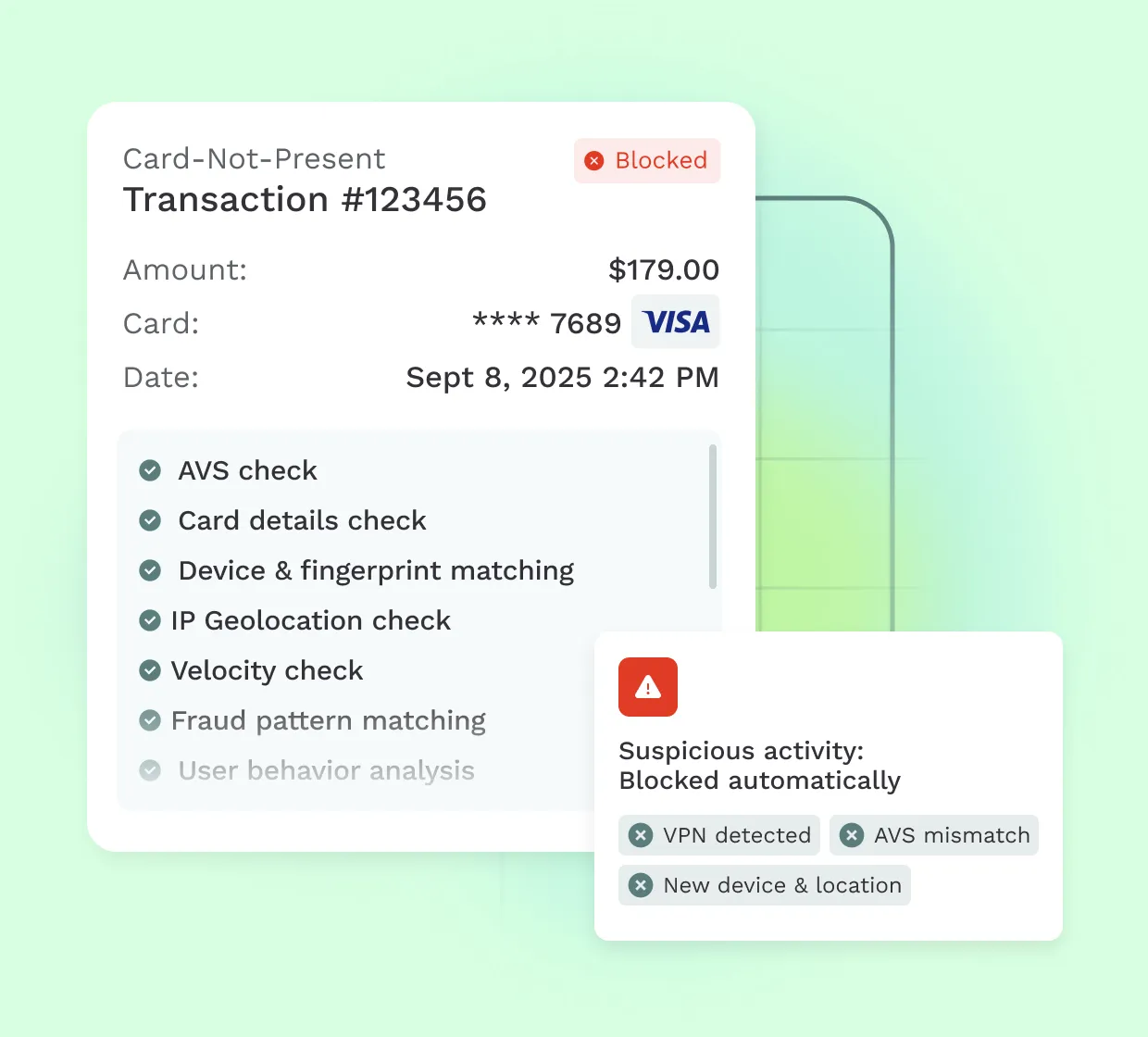

Card-Not-Present (CNP) Fraud Monitoring

Shield online payments and mobile checkouts.

- Tokenize card data to protect sensitive info.

- Use address and zip verification (AVS) and CVV/PIN checks.

- Ideal for eCommerce, telehealth, remote billing, and mobile-first services.

Integrations on Deck

No matter which payment gateway you use, Kurv is fully gateway-agnostic. We’ll protect your merchant account and prevent chargebacks, regardless of how your system is set up.

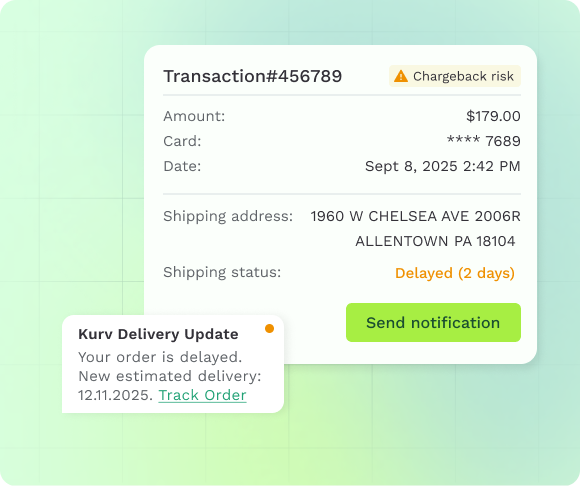

Friendly Fraud & Account Takeover Prevention

Friendly fraud occurs when a cardholder disputes a legitimate purchase—either by mistake, because they don’t recognize it, or intentionally, to get a refund while keeping the item. Kurv helps prevent both by:

- Flagging and identifying patterns of refund abuse, misuse of policies, false claims, and inconsistent customer behavior across accounts and devices.

- Preventing “Order Not Received” chargebacks with automatic shipping and delivery updates.

- Customizing billing descriptors and notifications to reduce confusion and disputes

Built for the Needs of Growing Merchants

The Kurv Advantage

Secure Customer Vault

Safely store card-on-file details for faster repeat transactions.

Centralized Dashboard

Process payments, track invoices, and access detailed transaction histories from any device.

Quick Approvals

Get approved within 24 hours through our proprietary underwriting technology and start selling ASAP.

No Hardware Dependency

Remove the need for card readers or physical terminals to make a sale.

Smart Risk Management

Flexible settings that protect your business across all scenarios while proactively detecting and stopping suspicious activity.

24/7/365 Support

Our dedicated on-call client success team and user-friendly self-service tools are here whenever you need.

Brian Sheffield

Local Zip

“They understand the specifics of our industry and make our processing work seamlessly. They treat us the way we hope to treat our customers.”

43% Growth in Net Sales

Sales climbed 43% in the first five years since partnering with Kurv.

10x Faster Payments

Kurv’s advanced tech increased payment speed more than tenfold.

90% Issues Resolved Remotely

Updates and fixes happen instantly. No downtime.

Frequently Asked Questions

What is merchant fraud protection and how does it work?

Merchant fraud protection is a set of advanced tools designed to safeguard your business from fraudulent activity. This includes tokenization to secure payment data, Address Verification Service (AVS) to confirm customer details, PIN verification, and filters that monitor transaction volume and thresholds. It also uses behavior and velocity analysis to spot suspicious patterns, automated software to detect fraud in real time, alerts for potential chargebacks, and automatic blocking features to prevent fraudulent transactions before they happen.

How is merchant fraud protection different from consumer fraud protection?

Merchant fraud protection is designed to shield businesses from fraudulent activities, including managing chargebacks to safeguard against disputes. In contrast, consumer fraud protection aims to protect individuals from issues such as identity theft and unauthorized transactions.

Can merchant fraud protection help prevent friendly fraud and false chargebacks?

Yes, Kurv’s merchant account prevention helps handle chargeback disputes by automatically detecting disputes, analyzing their root causes, and helping to resolve them.

Is Kurv’s fraud prevention software compliant with PCI and other standards?

Yes, Kurv adheres to Payment Card Industry Data Security Standards, ensuring the security of your and your customers’ data.

How fast can I implement Kurv’s fraud solution?

You can set up our fraud solution the same day the gateway is set up.

Payments You Can Trust, Peace of Mind You Deserve

Start accepting payments instantly

Join the 30,000+ businesses leveraging Kurv