Every retail business, from high-end clothing boutiques to hardware stores, is doing business differently in 2021.

We’re willing to bet that most (if not all) of the changes you implemented were made to keep your employees and customers safe. Did you follow one or more of the following recommendations?

- Offer curbside pickup or delivery options for purchases

- Designate shopping hours for the elderly and those most at-risk

- Sanitize shopping carts and checkout counters between each use

- Require customers and employees to wear face coverings in your store

- Add directional arrows to your aisles to keep the flow of traffic moving in one direction

- Encourage social distancing with signage and/or marked areas on the floor at checkout

If you managed to adapt your business to one or many of these suggestions, congratulations! Those are not simple changes to make, especially for small businesses.

Today, we’d like to suggest one more social distance-friendly option to add to the list above: contactless payments.[2] Retail Dive. “COVID-19 boosts contactless payment adoption: NRF” January 26, 2021. [/footnot

Key Takeaways:

- The term contactless payment refers to a secure method of purchasing products or services with a debit or credit card through Radio Frequency Identification (RFID) and Near Field Communication (NFC) technology.

- Some debit and credit cards have NFC technology that allows users to tap or wave their card above the terminal to complete their payment.

- To give your customers the option to use their NFC-enabled mobile wallet, you need a credit card terminal equipped with NFC technology. This will allow them to simply hover their smartphone above the terminal to make their purchase, eliminating the need for physical contact with the terminal or cashier.

Contactless Payments and COVID-19

Over the past year, many changes have occurred to our “normal” shopping habits in the United States. For example, customers who usually stop in to see what’s new may have started shopping online instead. Or, perhaps your customers who typically carry cash have started using their debit cards more often for purchases.

One trend that we’ve watched come to the forefront for retail businesses is the use of contactless payment solutions. In fact, according to a National Retail Federation and Forrester survey, “Since January 2020, no-touch payments have increased for 69% of retailers surveyed.”[1] NRF. “Coronavirus leads to more use of contactless credit cards and mobile payments despite cost and security concerns.” January 26, 2021. The survey also states, “Among retailers that had implemented contactless payments, 94% expect the increase to continue over the next 18 months.”

If you’ve been thinking about adding a contactless solution to your retail business, but aren’t sure if it’s worth the investment, take a look at that last quote one more time.

Among retailers that had implemented contactless payments, 94% expect the increase to continue over the next 18 months.

Still not convinced?

Type “contactless payment COVID” into your Google search bar, and you’ll see dozens of articles explaining how the COVID-19 pandemic has acted as a catalyst in the adoption of contactless payments.[3] DigiPay Guru. “How contactless payments are driving digital payment services in times of COVID-19?” January 26, 2021.

What Are Contactless Payments?

Contactless payment refers to a secure method of purchasing products or services with a debit or credit card using Radio Frequency Identification (RFID) and near-Field Communication (NFC) technology.

In other words, if you purchase a product or service using Apple Pay or Google Pay, you’ve made a contactless payment. Some debit and credit cards even have NFC technology that allows users to simply tap or wave their card above the terminal to complete their payment. These types of cards are called contactless payment cards.

NFC technology has many benefits, including:

- Transactions are incredibly fast; they can be completed in seconds

- Unlike Bluetooth technology, NFC does not require manual configuration, pairing, or settings

- NFC is more secure than traditional magnetic stripe payment cards

- Smartphone payments offer new revenue sources via marketing offers and loyalty programs that can be transmitted directly to the customer’s device

- NFC increases workplace efficiency

- It’s the most convenient way to pay!

Now, to give your customers the option to use their NFC-enabled mobile wallet, you need a credit card terminal equipped with NFC technology. This will allow them to simply hover their smartphone above the terminal to make their purchase, eliminating the need for physical contact with the terminal or cashier.

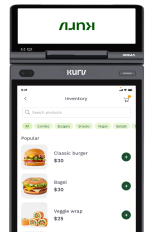

At Kurv, all our retail payment solutions are equipped with NFC technology. We also ensure our solutions are EMV-certified and offer the highest level of security possible, so you can accept payments knowing your business and customers are covered.

Are you ready to improve the customer experience with contactless payment solutions? Contact us today to discuss how Kurv can serve your business.